Throughout a qualified management in asset origination, structuring and identification of competitive funding sources, we’ve been able to secure favorable funding financial conditions in terms of cost and tenor.

Fixed-income securities for institutional clients (Banks, asset managers and insurers) are offered by our Funding & Institutional Relationships and Wealth Management Services teams, assuring the integrity and security of our financial processes in the Brazilian and international markets. We operate in the local market via instruments such as Financial Letters (LFs), Real Estate Credit Letters (LCIs), Agribusiness Credit Letters (LCAs) and Certificates of Deposit (CDs). Complementing this activity are funding operations in the global market, diversified across geographic regions such as Asia, North America and Europe, among others.

Our solidity is attested by two of the world’s leading rating agencies. Fitch awards BOCOM BBM its highest national scale rating, AAA(bra), and Moody’s rating is AAA.br, also the highest on its local scale.

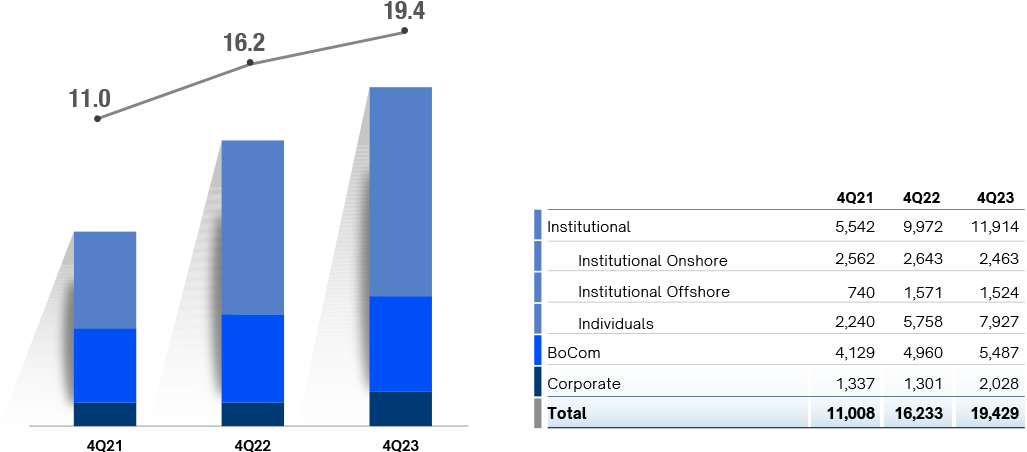

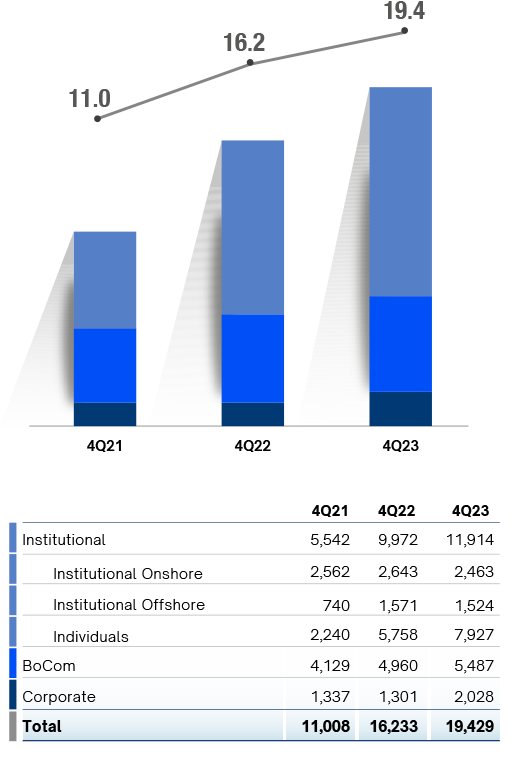

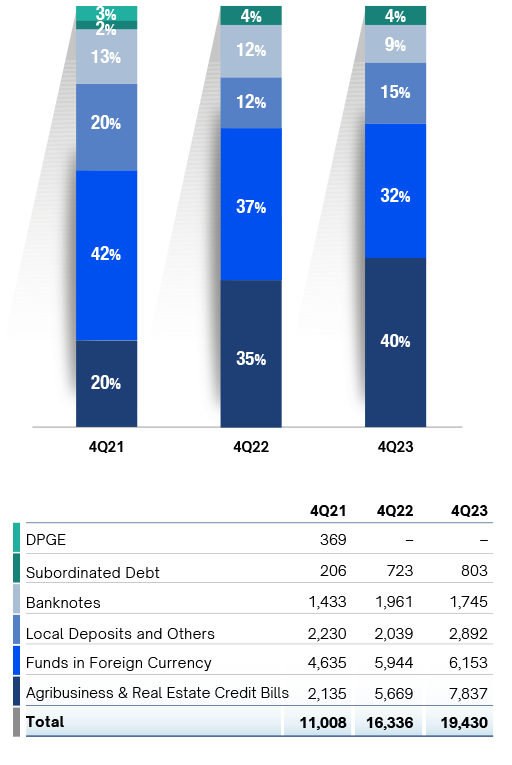

Funding

Type of Investor | BRL Billion

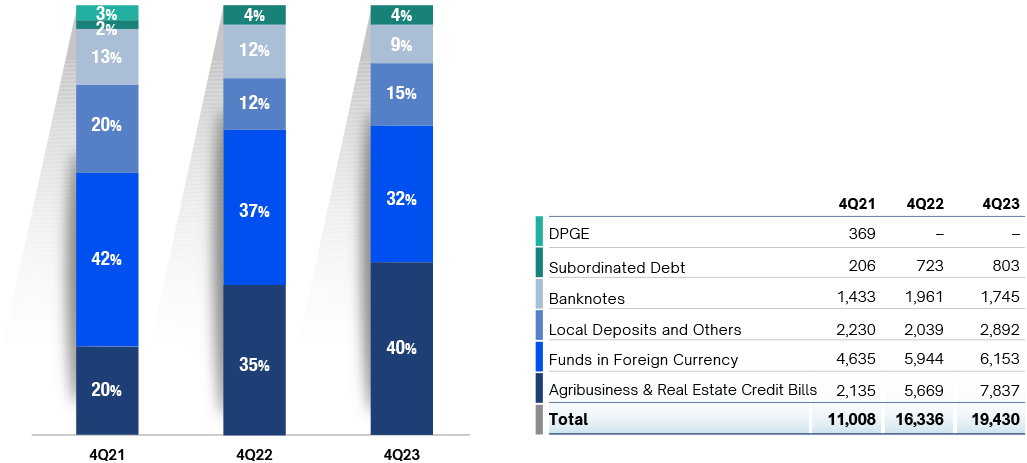

Funding

Sources

Risk control is fundamental to our decision-making processes. For decades we have refined our proprietary models and applied risk management methodologies that are better suited to the business environment in Brazil, prioritizing transparency and security in our activities.

Tools and guidelines integrated with our corporate governance structure, in conjunction with our long and qualified experience in capital protection and allocation, enable us to extend credit securely and achieve transparent and competent liquidity management.

Our history is distinguished by continuous improvement, and we have always been at the cutting edge of the Brazilian financial service industry.

Our Compliance team works with top management on a day-to-day basis to disseminate standards of integrity and information on responsible conduct to our staff, and to ensure that the Bank’s activities are conducted in conformity with the applicable laws and regulations. The compliance framework includes the Compliance Committee, which reports to the Board of Directors via the Executive Committee.

The four principles that guide our activities, established by our Code of Ethics and Conduct, are transparency, integrity, responsibility and excellence. Our decisions and activities are always oriented by a set of policies and internal procedures, and our rules are transparent and consistent.

This compliance culture is disseminated to staff by means of periodic training sessions, monitoring, and the production of internal normative documents.

This is how we act to prevent money laundering, and to combat terrorism financing and corruption.

Risk monitoring, assessment and control are part of Banco BOCOM BBM’s governance and decision-making processes in all areas. All our teams use risk models and parameters in such activities as calculations of economic capital, funding policy, origination, and credit portfolio management.

Our risk management guidelines, responsibilities and models are instated by the Board of Directors, which also approves the Risk Appetite Statement (RAS), the document that serves as a basis for our risk control policies and practices. This strategy enables us to manage our capital prudently and efficiently, in conformity with the institution’s risk appetite.

Risk is monitored by daily calculation of Value at Risk (VaR). VaR is a statistical tool used to measure the institution’s potential loss under normal market conditions for a given confidence level and timeframe. The model for calculating VaR is regularly backtested.

The limit we set for VaR can be allocated among the many risk factors by the Chief Treasury Officer. Stress scenarios are established every quarter by the Risk Committee, with autonomy from the management areas, and these scenarios are analyzed on a daily basis by the Bank’s team.

Credit risk is the possibility of losses associated with failure by borrowers or counterparties to honor their financial commitments on time and in accordance with their contractual obligations.

The Credit Committee, the Board of Directors and five other areas of the Bank – Credit Risk, Credit Analysis, Legal, Contract Management and Internal Auditing – constitute our framework for managing credit risk, which functions as outlined below:

Sets credit limits for business groups; tracks and assesses the portfolio and levels of concentration and risk; executes the Bank’s credit policies; and establishes deadlines for solutions to issues relating to past-due loans or to deteriorating loan guarantees. If debt collection via the courts is necessary, for example, it decides when to file suit.

Approves risk management policies and limits at least once a year.

Responsible for monitoring, identifying, measuring, controlling and reporting credit risk, and assuring compliance with the limits set by the Bank. Subordinated to the Chief Risk Officer, it centralizes and analyzes information relating to the management of individual risk per transaction and consolidated credit portfolio risk. It produces reports that are used by the Credit Committee as a basis for its decisions.

Analyzes the credit risk of business groups with which the Bank has or plans to have credit relationships.

Draws up or analyzes all contracts signed by the Bank with clients; organizes and coordinates action to collect debts and protect the Bank’s rights.

Ensures that transactions comply with the terms and conditions stipulated in the Credit Limit Proposal (CLP), and that loan security is in order. Also responsible for issuing the contracts signed by the Bank with clients.

Assesses and continuously monitors all business units and credit facility extension processes to ensure they are implemented in accordance with the Bank’s governance and risk management policies.

Market risk is the possibility of losses in the market value of portfolios, instruments or investments due to variations in prices, interest rates or exchange rates. Inflation and fluctuations in stock and commodity prices are some of the key market risk factors.

Back in 1997, we created an advanced proprietary system that became an industry benchmark. Using specialized tools and personnel, we identify, measure and monitor the Bank’s exposure to market risk. The Market Risk unit reports to the Chief Risk Officer (CRO) and shares its analyses with the Risk Committee and the Executive Committee. The unit comprises the following:

Meets every quarter to analyze and review risk management policies, sets operational limits for market risk, and presents these to the Board of Directors for approval.

Calculates and manages risk metrics.

Responsible, among other things, for the pricing models and sources used to mark products to market. It does so independently of management areas.

Ensures that our market risk management policies are consistent and adequate to procedures.

Liquidity risk is the possibility of mismatched maturities, indexation mechanisms, currencies and/or values of possible payments and receivables. In practice, it is the risk that the institution is unable to honor its financial obligations, expected and unexpected, without affecting day-to-day operations and without incurring significant losses.

In accordance with the guidelines pre-defined by the Risk Committee and approved by the Board of Directors, the liquidity risk management strategy is oriented by the Bank’s liquidity goal, which is to guarantee sufficient funds to honor all liabilities and commitments at any time. The aim is to ensure that free cash flow will always be sufficient to support business continuity even in a situation of severe stress.

Our team analyzes the information needed for liquidity risk management and performs calculations considering a number of variables to analyze potential liquidity risks, such as projections for cash flow in expected scenarios and situations of financial stress, implicit risk for each client, additional funds required to settle debts, operating losses, marking to market of derivatives, and other obligations.

The main remit of Liquidity Risk, which reports to the Chief Risk Officer, is to assure compliance with operating limits and issue internal reports designed to contribute to decision making. As part of the process, Internal Auditing acts to guarantee the adequacy of procedures and consistency across policies and the actually implemented framework.

Operational risk is the possibility of losses resulting from failure, deficiency or inadequacy of internal processes, systems or people, as well as from fraud and external events. It includes legal risk, which is the possibility of problems relating to legislation or court orders that may hamper the Bank’s business activities.

Our Operational Risk Management Policy is a document made available throughout the Bank to formalize the methodology, processes, roles and responsibilities in procedures for document registration and storage of the information used to manage operational risk. Segregated from Internal Auditing and reporting to the Chief Risk Officer, it is also responsible for publishing data to ensure that risk management activities are transparent. In accordance with this policy, all decision making follows best practices and complies with the applicable rules and regulations.

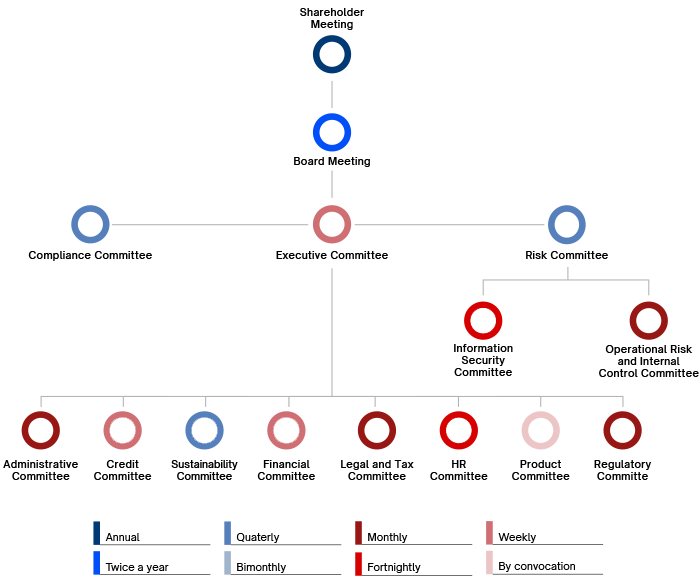

Fifteen bodies make up our governance structure: Shareholder Meeting, the Board of Directors, the Executive Committee, and 13 specialized committees.

Banco BOCOM BBM’s guidelines are constantly updated so as to be always in accordance with best practices in the industry, and our actions reflect our values: transparency, agility, efficacy, and security.

Corporate GovernanceValuing all members of our staff is part of our culture. We believe that by acting in this manner we build a solid pathway for our business.

We work continuously to identify professionals with high potential and strive to support the fullest possible development of their skills via interaction with a highly qualified team who are ready to contribute.

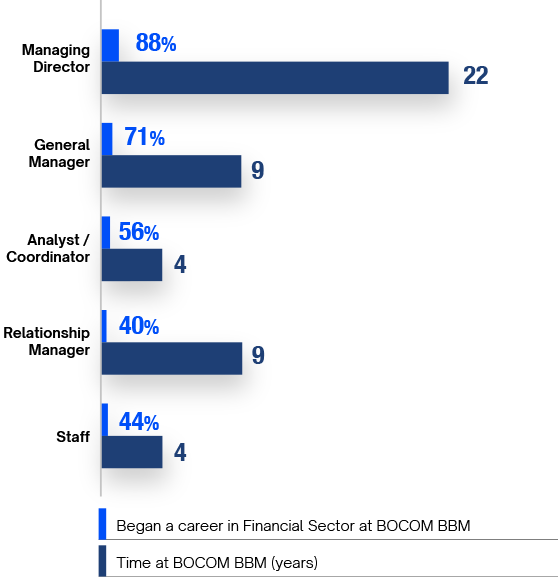

Our investment in the professional development of our staff is also evidenced by the fact that around 80% of our senior executives and 70% of our managers began their careers in the industry at BOCOM BBM.

We believe that by maintaining a transparent, dynamic and meritocratic workplace we are contributing to the future of our people and our business.

Managers keep a close eye on the progress of each individual member of their teams. A semiannual variable bonus is awarded on the basis of an assessment process that balances individual and collective performance, ensuring that personal growth keeps pace with the Bank’s long-term results.

In addition to providing a workplace climate that offers real growth opportunities for all, we work to ensure that our actions are always transparent, fair, and aligned with our Code of Ethics and Conduct.

As part of our talent attraction strategy, we partner with renowned centers of higher education and research to offer scholarships for graduates and undergraduates at the best Brazilian universities. We also invest in the continuous education of our staff, encouraging them to develop academically by enrolling in MBA courses and other graduate programs.

In addition, we sponsor conferences, career fairs and hackathons because we believe in the benefits of interaction between students and professionals.

Professional Growth

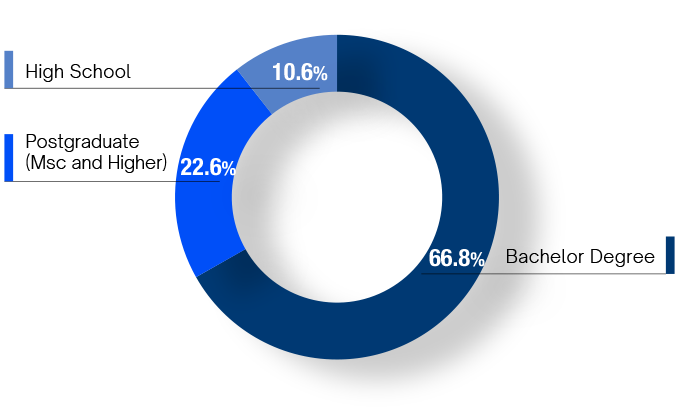

Academic Profile