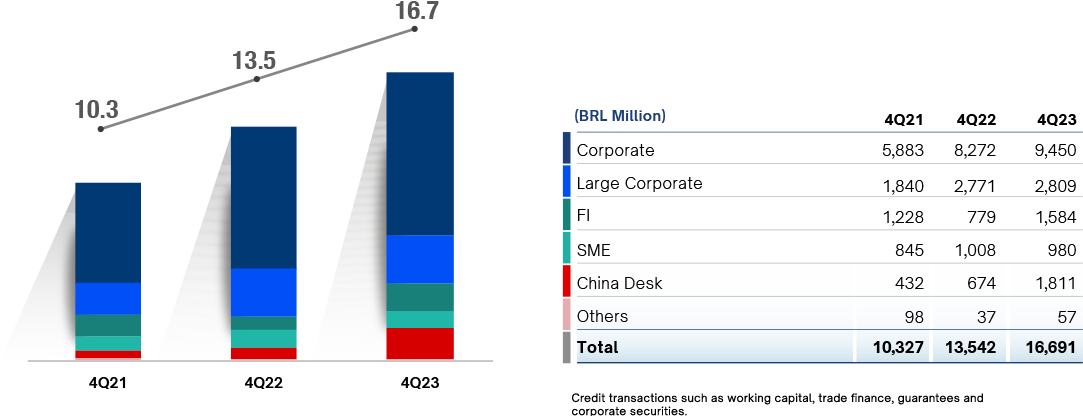

Our expanded credit portfolio grew steadily in 2023, reaching BRL 16,7 billion, including Guarantees Issued.

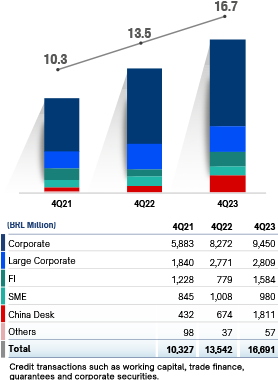

The Brazilian economy grew above the global average in the year, boosting financial activities and the profitability of operations. BOCOM BBM contributed to this expansion via its credit operations, especially for agribusiness companies, resulting in net income of BRL 274 million at year-end.

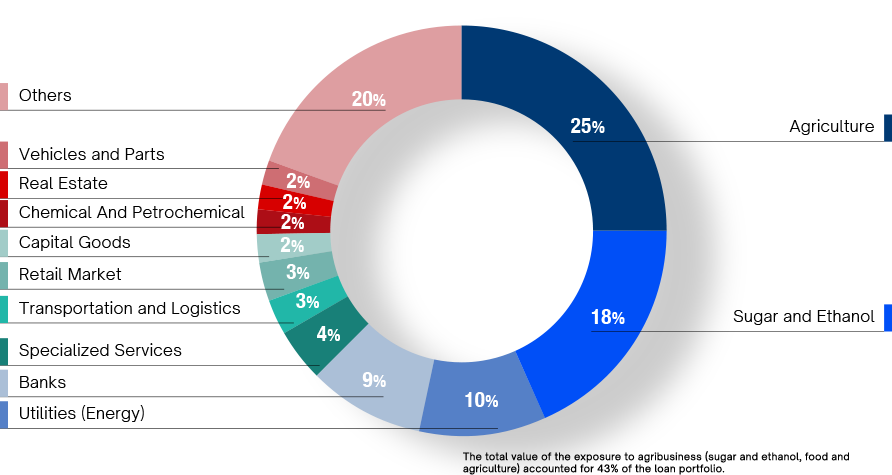

Our business focuses on small and medium enterprises (SME), companies in the Corporate and Large Corporate segments and also Chinese companies in Brazil, offering loans with a range of collateral types, in local and foreign currencies.

We are ready to meet our clients’ needs, be they in credit, financial services, or derivatives. We want to build connections and help drive business volume growth.

Total Expanded Credit Portfolio

BRL Billion

Total Expanded Credit Portfolio

Breakdown by Sector | DEC 23

Total Expanded Credit Portfolio

Breakdown by Transaction | DEC 23

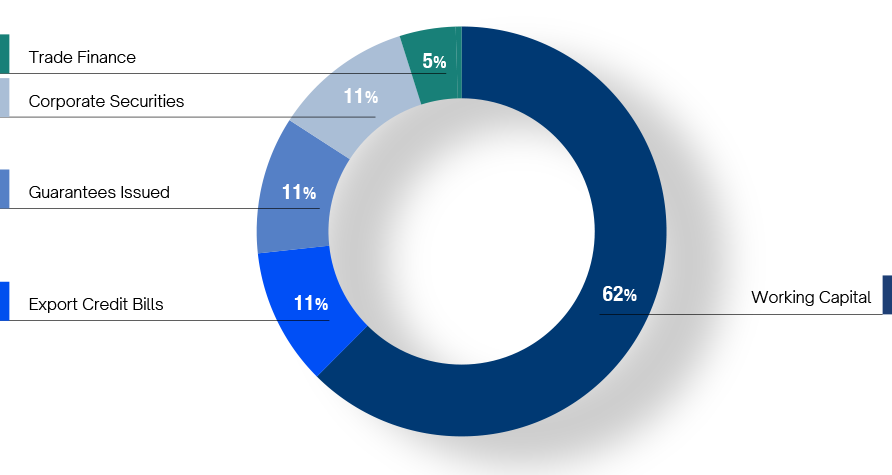

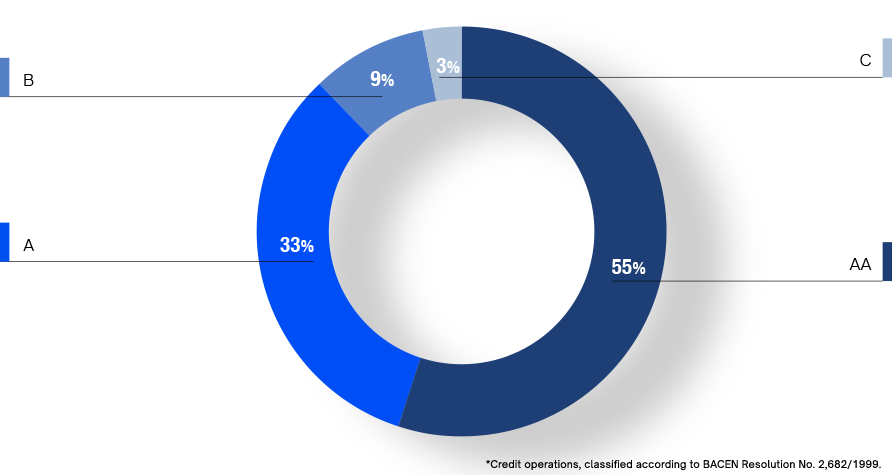

Loans and Guarantees Portfolio*

Risk Rates | DEC 23

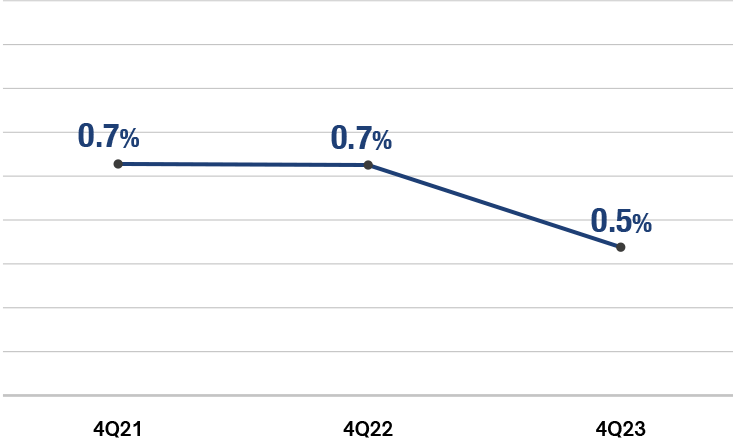

Allowances for Loan Losses

Loans and Guarantees Portfolio

In 2023, our Asset Management unit ended the fourth year since its inception with BRL 2.3 billion in assets under management.

The unit’s main activity is the management of investment funds focusing on corporate debt, in pursuit of positive results in the medium to long term. Its differentiators include BOCOM BBM’s excellence in investment management, macroeconomic research, and credit analysis and monitoring.

Our portfolio comprises five investment funds for all levels of risk appetite, from the general public to highly qualified investors: BOCOM BBM Corporate Credit High Yield, BOCOM BBM Corporate Credit, BOCOM BBM Icatu Previdência, BOCOM BBM Cash, and BOCOM BBM Cash Enhanced. Recently, BOCOM BBM Corporate Credit had its redemption time reduced from 60 days (T+60) to 30 days (T+30), reflecting the growth of this market since the funds were created in 2019.

Many events that affected the financial services industry occurred in 2023, yet our Asset Management business achieved consistent returns and maintained capital protection, evidencing its experience in fund management and analysis, as well as its sound governance.

Our investment funds

BOCOM BBM Cash

Focus on sovereign bonds and banking assets

BOCOM BBM Cash Enhanced

Focus on banking assets and high – grade high liquidity

BOCOM BBM Corporate Credit

Focus on high – grade assets with diversified portfolio

BOCOM BBM Previdência

Focus on high – grade assets with diversified portfolio

BOCOM BBM Corporate Credit High Yield

Broad mandate with diversified portfolio

High net worth individuals and families resident in Brazil and abroad rely on our strategic partners to preserve and expand their wealth.

In Wealth Management Services we offer an open-platform model that provides access to the best financial products and services on the market. This approach enables our clients to choose freely from a wider variety of solutions, including both local and foreign assets.

Looking for the scalability and flexibility of our partners, we offer a range of personalized private banking products and services, such as credit, treasury instruments and representation of non-residents, among others.

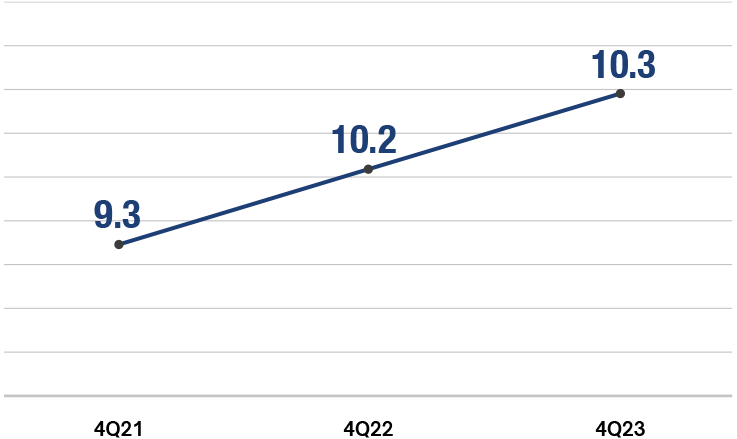

Total Resources Distributed and Customed by Wealth Clients

BRL Billion

We offer a wide array of financial products and services for Debt Capital Markets. Working with Corporate Credit, we identify clients who are qualified to engage in market issuance in order to provide new options for them to raise capital. Combining our credit expertise and diligency with our market knowledge, we offer a complete solution in capital market products and structures for first issuers, as well as recurring issuers.

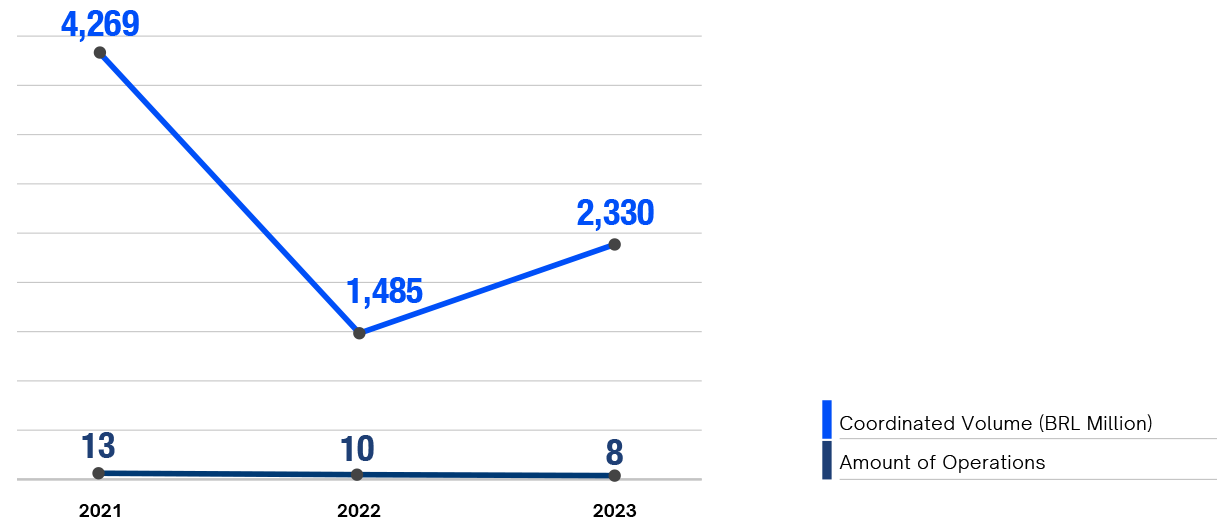

We coordinated issues of agribusiness receivables certificates (CRAs), mortgage-backed securities (CRIs), debentures and commercial paper, comprising 8 offerings worth a total of BRL 2.3 billion.

Considering only CRAs, we coordinated issues worth BRL 700 million in 2023, a growth of 24% compared to 2022.

DCM

Treasury is responsible for ensuring that the Bank remains liquid and for laying the basis for prices and volumes of the conglomerate’s assets and liabilities.

The department structures and prices derivatives and other products in conjunction with Corporate Credit. Its remit is to present alternatives for companies to address the market risks to which their balance sheets are exposed.

It offers derivatives for hedging against the risks associated with exchange-rate fluctuation, interest-rate variation, and swings in commodity prices and price indices, as well as various types of foreign-exchange service and management of a range of market risks.

The notional value of the portfolio of derivatives with clients rise 48% in 2023, ending the year on BRL 5.5 billion.